Taiwanese businesses are the least inclined in the Asia Pacific to sell on credit. Get your copy of the latest payment practices barometer and find out why.

The economic outlook for Taiwan seems less optimistic than one year ago. Domestic demand, mainly impacted by low wage growth and a reduction in tourists from mainland China, still awaits support from fiscal stimulus and large investments. Export demand from key markets such as mainland China and Hong Kong has cooled down, and the repercussions of the still unsolved and potentially escalating Sino-US trade dispute are not making the picture brighter. This is also the sentiment expressed by half of Taiwanese respondents, who are concerned about a negative impact of the worsening of both the global and domestic economies on their business.

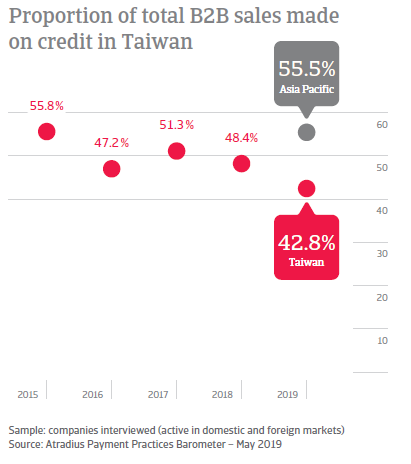

Taiwanese businesses the least inclined in Asia Pacific to sell on credit to their B2B customers

With such uncertainty on the doorstep, future trends are not obvious. What is however clear is that this year Taiwanese respondents are being more cautious in their sales transactions by offering customers credit less often. 57.2% of the total value of B2B sales in Taiwan was transacted on a cash basis (up from 51.6% last year) and 42.8% was made on credit terms (down from 48.4% one year ago). Interestingly, the proportion of B2B sales transacted on credit by Taiwanese respondents stands out as the lowest in Asia Pacific, and compares to a 55.5% average for the region.

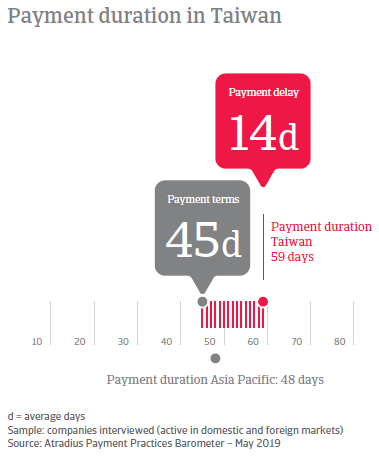

Most liberal payment terms in Asia Pacific, barely changed since last year

The more cautious approach of Taiwanese respondents to selling on credit terms appears to be in contrast to the payment terms extended to their B2B customers. At 45 days from the invoice date, they are the most liberal in Asia Pacific. Although 1 day shorter than last year, they remain markedly above the 32 days average of the region.

Checking buyers’ creditworthiness most used credit management practice in Taiwan

With such liberal payment terms in place, it is not surprising that the assessment of the B2B customer’s creditworthiness, prior to any trade credit decision, plays a pivotal role in so many respondents’ (43%) credit management policy. Reserving against bad debt is a common practice used by Taiwanese respondents almost as often as checking creditworthiness.

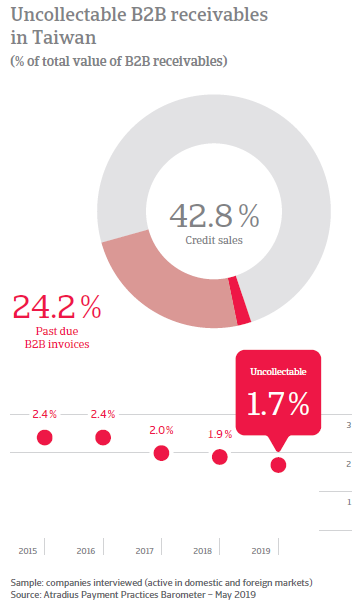

The insolvency environment still benefits from 2018’s more benign economic conditions

In Taiwan, there was a 13% increase in the proportion of B2B invoices paid on time. This is higher than the 8.5% regional average. Overdue invoices decreased correspondingly, and now amount to 24.2% of the total value of B2B invoices issued by local respondents (below the 29.8% regional average). Both changes reflect faster payment from customers of Taiwanese respondents. Their past due invoice to cash conversion pace has, on average, decreased 10 days from 69 days to 59 days). There was also an improvement seen in the proportion of B2B receivables written-off as uncollectable, to 1.7%, down from 1.9% one year ago.

7 in 10 Taiwanese respondents suffered from late payment by customers over the past year

Despite the more favourable conditions of the insolvency environment, a staggering 70% of Taiwanese respondents negatively impacted by the impact of late or non-payment of invoices over the past year. To maintain adequate cash flow levels 39% said they had to delay payments to their suppliers and 37% said they had to take other measures to correct cash flow.

Buyer’s creditworthiness checks to increase in Taiwan over the next 12 months

Nearly 60% of Taiwanese respondents said they do not expect any change in the payment practices of their B2B customers over the coming months. 19.2% anticipate an improvement, while 25% expect deterioration. Those expecting worsening payment behaviour anticipate an increase in late payments but notably also in invoices more than 90 days overdue. To protect their businesses against payment default by their customers, 60% of Taiwanese respondents reported they will check the creditworthiness of their buyers more often, while 51% they will monitor their customers’ credit risk more often over the next 12 months.

Overview of payment practices in Taiwan

By business sector / industry

Average payment terms longest in both the services and in the ICT/Electronics sectors; Shortest in both the wholesale/retail/ distribution and in the consumer durable sectors

On average, respondents from the services sector in Taiwan extended the longest (57 days), and those from the wholesale/retail /distribution sector the shortest (34 days) payment terms to B2B customers. At industry level, average payment terms ranged from a high of 45 days in the ICT/Electronics industry to 40 days in the Consumer durables industry.

Speed of payment from B2B customers improved the most in the services sector and the ICT/Electronics industry

Over the past year, the services sector and the ICT/Electronics industry in Taiwan recorded the highest increase in the proportion of B2B invoices paid on time (12.4% and 14.1% respectively). As a result, overdue invoices of respondents in the services sector have fallen to 17.6% of the total value of B2B invoices issued. This compares to an average of 29.0% in both the manufacturing and the wholesale/retail/services sectors and to 27.1% in the ICT/Electronics industry.

Credit insurance helps businesses compete more effectively by enabling them to offer better credit terms

Wholesale/retail/distribution sector and the consumer durables industry have the highest proportion of uncollectable receivables

The wholesale/retail/distribution sector in Taiwan recorded the highest proportion (1.8%) of B2B receivables that were written off as uncollectable. At 2.2%, the level of uncollectable invoices was even higher in the consumer durables industry. The manufacturing and services sectors recorded 1.6% of receivables being uncollectable and ICT/Electronics industry 1.2%.

By business size

Large enterprises in Taiwan extended the longest, and micro-enterprises the shortest average payment terms to B2B customers

Payment terms of respondents from large enterprises in Taiwan averaged 49 days while those of micro- enterprises averaged 39 days from the invoice date.

Faster payments form B2B customers of both large and micro-enterprises

Over the past year, respondents from both large and micro-enterprises in Taiwan saw improvement in the frequency of invoices being paid on time (+16% on average). As a result, overdue invoices in the large enterprises are now nearly 30% of the total value of invoices issued in B2B trade, and 17.0% on average for survey respondents from micro-enterprises. Conversion of past due invoices into cash this year’s survey ranges from an average of 71 days in large enterprises to an average of 48 days in micro-enterprises.

Large enterprises recorded the highest rate of uncollectable receivables

Large enterprises in Taiwan recorded the highest proportion (2.2%) of B2B receivables written off as uncollectable. the average for SMEs was 1.9% and for micro-enterprises 1.0%.